Greetings from Emergents @ Weild & Co and welcome to Emergence Bytes, where we dish out quick but original takes on what we’re seeing in the blockchain and digital asset markets.

Topics We Cover

👩💻Featured Insight: Deeper Global Recession and Flow of Money

👩💼Crypto Mom For SEC Commissioner?

💸Capital Activity

📰 Emergents @ Weild & Co. in the News!

🎧Podcasts We’re Listening To

🎟Events We’re Attending

👨💻 Featured Insight

Deeper Global Recession and Flow of Money

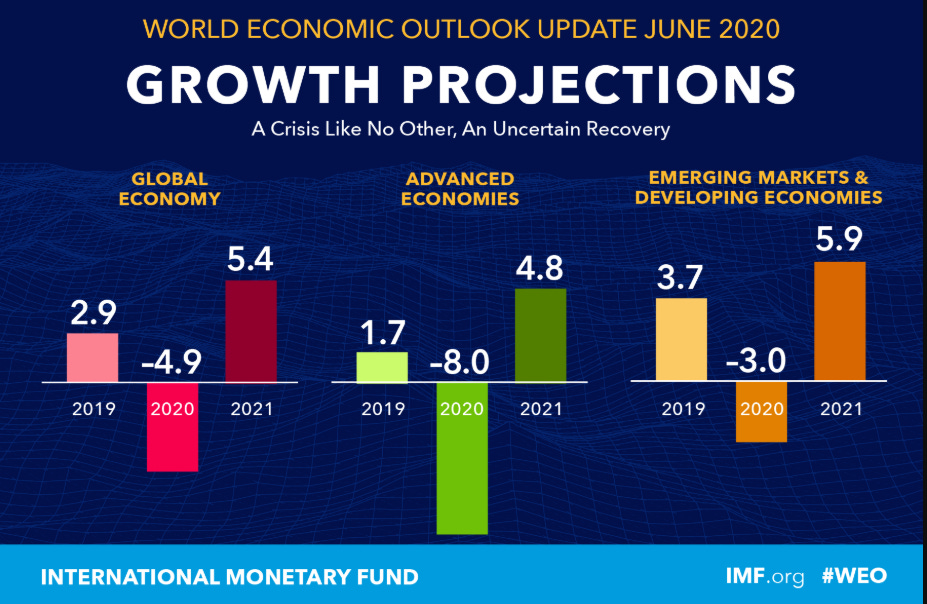

As per the June 2020 WORLD ECONOMIC OUTLOOK REPORT issued by the International Monetary Fund (IMF), global growth is projected at –4.9 percent in 2020 and the world is heading into a deeper global recession than anticipated due to the COVID-19 pandemic. Below chart shows the overall projections:

To sustain the economy, strong multilateral cooperation remains essential on multiple fronts. Liquidity assistance is urgently needed for countries confronting health crises and external funding shortfalls, including through debt relief and financing through the global financial safety net.

Some of the highlights beyond the pandemic to consider from June 2020 report:

Policymakers must cooperate to resolve trade and technology tensions that endanger an eventual recovery from the COVID-19 crisis.

Building on the record drop in greenhouse gas emissions during the pandemic, policymakers should both implement their climate change mitigation commitments and work together to scale up equitably designed carbon taxation or equivalent schemes.

The global community must act now to avoid a repeat of this catastrophe by building global stockpiles of essential supplies and protective equipment, funding research and supporting public health systems, and putting in place effective modalities for delivering relief to the neediest.

We clearly see a trend here. The hottest areas where the investors’ money is flowing: Clean Energy, Healthcare, Automation, Data Privacy, Artificial Intelligence, and Cyber Opticals. On June 23rd, 2020, Amazon announced a $2B Climate Pledge Fund that will invest in companies across industries such as transportation and logistics, energy, storage and utilization, manufacturing and materials, and Food and Agriculture. In the past, Microsoft co-founder Bill Gates and other heavyweight investors Softbank Group CEO Masayoshi Son, Virgin Group founder Richard Branson, and Alibaba Group executive chairman Jack Ma have launched similar funds to boost clean-energy innovation. Facebook had invested $5.7 Billion in India’s top telecom network, Reliance’s Jio, which has the world’s biggest telecommunications user base.

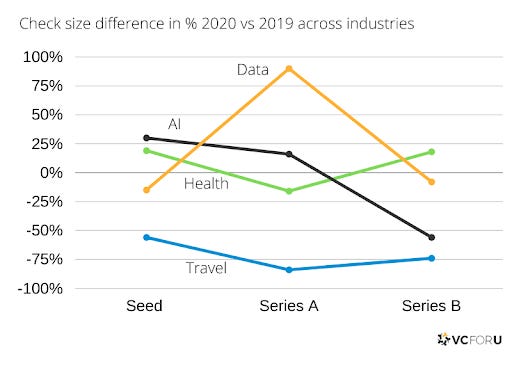

By analyzing the investment trends in the last 3 months, on average, check sizes did not change, however, the industry investment has a completely different picture. A look at the data by industry shows there is a different trend in each sector across investment types.

Money never disappears, it only exchanges hands in different amounts and velocities. The question for current and future entrepreneurs is: what are they building to make this world a better place and can they take a piece of the pie by being at the right place at the right time?

👩💼 Crypto Mom for SEC Chair?

The big story this week is unquestionably the imminent departure of soon to be former SEC Chairman Jay Clayton. With his departure all but certain, will Hester Pierce AKA Crypto Mom replace him? And if so, what does that mean for the industry?

The obvious implication here is Crypto Mom will usher in a new era of crypto-progressive regulation, thus positioning the United States as a world leader in digital innovation. But what does that mean specifically? Which companies stand to benefit? And have we as an industry built the requisite infrastructure to support the upward shift in demand for crypto products and services?

Companies Poised To Benefit

Crypto payment providers. Crypto-friendly regulations equal increased ownership of digital assets. Accordingly, we see a corresponding increase in demand for crypto payment solutions such as Bakkt’s forthcoming payment applications which allows anyone holding major crypto assets to convert their tokens into cash to buy common goods and services. Other such companies include Lolli and Flexxa Network. Furthermore, COVID-19 has amplified the need for increased access for contactless payment rails, which all crypto payment providers are positioned to provide.

Aspiring Bitcoin ETF providers. These companies include Bitwise, Wilshire Phoenix, VanEck, NYSE Arca, and the Winklevii’s Gemini (to name a few). The recent explosion in demand for the Grayscale Bitcoin Trust proves the demand for publicly traded crypto products, so we anticipate a Pierce administration to usher in renewed efforts to launch crypto ETF products.

Stablecoin companies. We’re already seeing a massive increase in demand for consumer stable-value crypto products as a result of the recent DeFi boom. We think there will be a coinciding increase in demand for enterprise stablecoin solutions. Enterprise stablecoin solutions include those that facilitate streamlined employee compensation for multinational companies, supply chain financing, and other cross-border payment needs. Companies providing these solutions include R3 Corda, JPMorgan Chase, and potentially even FaceBook’s Libra Project.

Tokenization companies. In our view, security tokens are such a no-brainer; it’s only a matter of time before all legacy financial products will be tokenized. As a result, companies that issue and facilitate the trading of tokenized assets would benefit tremendously from the SEC shifting their perception on tokenized assets. These companies include Securitize, Tokensoft, tZERO, and Symbiont.

In other news…Paypal and Venmo Are Betting on BTC

Paypal and Venmo have finally joined the bitcoin party. Venmo’s primary competitor, The Cash App, has been bullish on bitcoin for quite some time. In fact, the stock of Cash App’s parent company, Square, surged 10% on Wednesday, achieving new all time highs on the back of accelerated consumer bitcoin activity. It appears Paypal and Venmo are not keen on missing the bitcoin opportunity.

This development is welcomed by crypto community. Paypal/Venmo has 325 million customers. Every account will be retrofitted with bitcoin wallet functionality. Thus, the implication is clear: PayPal has the potential to be the single largest catalyst for bitcoin adoption, full stop.

💸 CAPITAL ACTIVITY

Blockchain Activity

SYNCA, the parent company of OMG Network (formerly OmiseGO) has raised $80M from Siam Commercial Bank, SPARX Group, and Toyota Financial Services Group to help Asian merchants adopt contactless payments.

Digital asset custodian Komainu launched by Nomura and Partners to enable higher adoption of digitized assets supported by blockchain.

W3BCloud, a JV between AMD and ConsenSys, raised $20M from the aforementioned companies and several family offices to operate and scale global Ethereum data centers to empower a decentralized economy.

Popular soccer club FC Barcelona’s token sale hits $1.3M cap within a few hours as fans clamor to get a piece of the ‘engagement’ pie.

Activity Elsewhere

Unilever plans to invest $1 billion euros in a climate change fund and reach New Zero emissions by 2039.

DTC insurer Oscar Health nabs $225M as COVID forced people to embrace telehealth and brought down insurance costs.

FirstMark Capital raises $650M capital to make seed and Series A investments.

📰 Emergents @ Weild & Co. In the News!

David Weild, Founder and Chairman of our Broker-Dealer Weild & Co., was featured in one of our industry’s top publications - Cointelegraph!

🎧 Podcasts we’re listening to

Unconfirmed: Yield farming. Everyone in DeFi is talking about it, but nobody knows what it means. Leave it to Laura Shin to skillfully break it down for us.

Insureblocks: Learn how UNICEF is utilizing blockchain.

The Twenty min VC: How COVID has changed fundraising for funds. A great supplement to our previous edition of Emergence Bytes (shameless plug).

🎟 Upcoming Events We’re Attending

Unitize: July 6th-10th

Crypto Hedge Fund Summit: July 22nd-23rd

Fintech Disruption Summit: Sep 3rd

Please use this Feedback Form to provide suggestions and give constructive criticism!

References (extra readings): IMF Report, Americans for Tax Fairness, WSJ, Geekwire, TechCrunch, Crunchbase

Glossary of Terms

Tokenization: The process of replacing sensitive information with unique identification symbols that retain all the essential information about the data without compromising its security.

Stablecoins: Blockchain-enabled stable value assets pegged to fiat currencies such as USD, Euro, Yen, and other prominent government-issued currencies.

Cyber optics: The theory/science of communication and control in the animal and the machine. The art/study of governing, controlling automatic processes and communication.

About Emergents @ Weild & Co

We are tech investors, wall street veterans, blockchain enthusiasts, and university professors focused on providing comprehensive investment banking and tokenization services to innovative issuers.

We are one of only a few i-banks in the world that believe in and work with blockchain-enabled assets.

Reach us at emergents@weildco.com - always happy to connect!